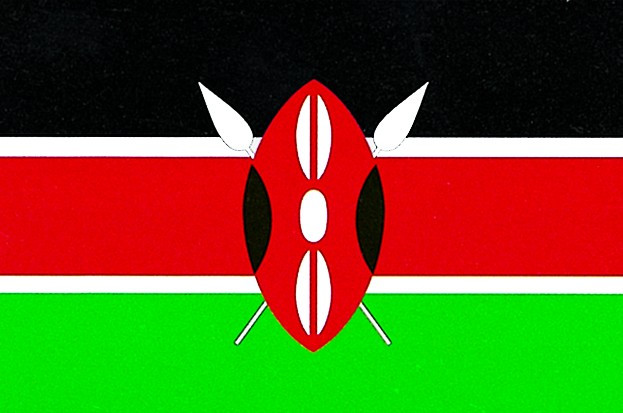

| Kenya to set new tax payments (2016/11/11) |

|

The Betting Control and Licensing Board (BCLB) of Kenya announced an increment in tax payments for the gambling industry. Operators of gaming services and lotteries would pay new levies on earnings. Currently, gaming companies pay income tax and withholding tax, in instances where the latter applies, such as annual dividend. Although experts explained that the increment in tax contribution to the country helped developing social benefits for Kenyans, the high level of percentage destined to the State’s revenues could decline the interest of operation companies in the market. As regional press commented, the new tax measures could end with gambling services in Kenya.

Kenya Revenue Authority (KRA) policies have boosted the government administration of economic issues. Over the last decade, the KRA operations have led to remarkable growth in State’s revenue, which meant an increment in the benefits destined to road construction and upgrades, electricity generation and other infrastructure projects. Furthermore, gambling taxes contributed with Kenya’s investment in free maternal healthcare and free primary education. The new tax measures could develop the social benefits by the State, but according to operator’s vision, the government decision is pushing operators to this tipping point.

|

|